As a Forex trader, you certainly know that the USD is by far the most traded currency in the world. And you probably also know that USD/EUR is the most traded currency pair in the world. But what about the other currencies? And how important are the U.S. dollar and the Euro in international comparison?

We have evaluated the statistical data from the Bank for International Settlements (BIS) which has been published in this document. All data are daily averages for April 2010.

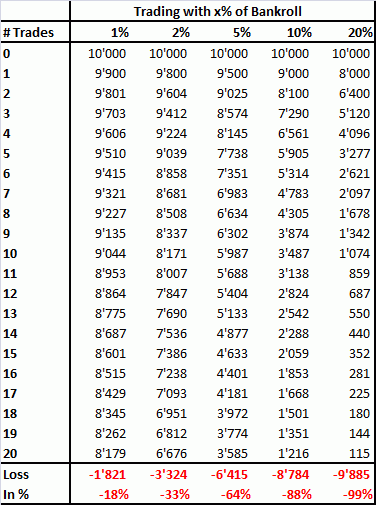

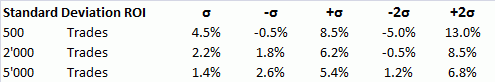

Forex Market Turnover by Currency Pair

The daily global Forex trading volume amounts to a total of 4 trillion dollars. 28% of this volume is attributable to the currency pair USD/EUR, another 14% to USD/YEN and 9% to USD/British Pound. According to the statistics, these three currency pairs amount for half of global trade volume:

In positions four to ten follow:

• USD to Australian dollar, Canadian dollar, Swiss franc and Hong Kong Dollar

• Euro to Yen, Pound Sterling and Swiss francs

These sum up to an additional 25% of global foreign exchange trading. Altogether, the top ten currency pairs are responsible for three-quarters of all FX trades.

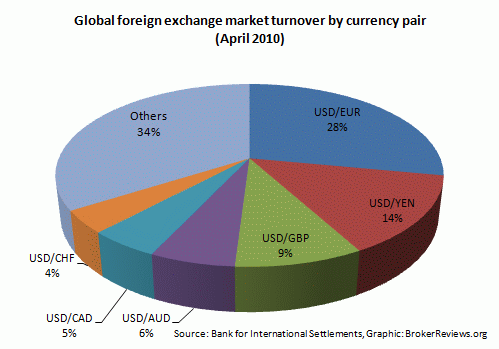

Most Important Currencies in Forex Trading

A similar picture emerges when one considers not the currency pairs, but the single currencies. Because currencies are traded in pairs, the total sum is 200%. As you can see in the following pie-chart, the U.S. Dollar, the Euro, the Yen or the British Pound are involved in more than three quarters of all currency transactions worldwide.

As you can see from this table, significantly less important compared to USD, EUR, JPY, GBP, AUD, CHF and CAD are currencies such as the Swedish Krona or the New Zealand dollar:

U.S. Dollar: 85%

Euro: 39%

Japanese Yen: 19%

British Pound: 13%

Australian Dollar: 8%

Swiss franc: 6%

Canadian Dollar: 5%

Hong Kong Dollar: 2%

Swedish Krona: 2%

New Zealand Dollar: 2%

South Korean Won: 2%

Singapore dollar: 1%

Norwegian krone: 1%

Mexican Peso: 1%

Indian Rupee: 1%

Russian ruble: 1%

Polish zloty: 1%

Turkish lira: 1%

South African Rand: 1%

Brazilian real: 1%

Others: 9%

Total: 200%

That does not mean that the minor currencies cannot be traded because that market is less liquid. Just as an example: every day, Yen and Australian dollar with equivalent of around 25 billion USD are traded. Also with this currency pair, buyers and sellers are matched within a very short time frame during an FX trade.

Please note that not all Forex brokers offer an equally large number of FX pairs. Depending on the broker, these figures can vary between about 20 and more than 100. If you are looking for a broker where you can trade more exotic currencies online, then you should check that figure before signing up.

In our table on BrokerReviews.org we provide an overview of the number of currency pairs for each Forex broker we have reviewed. Over a hundred currency pairs can be traded for example with <easyMarkets, a broker which we recommend you to check out now.