Liberty Reserve is an online payment service that is similar to PayPal, Moneybookers and Neteller. Because Liberty Reserve (or short just LR) is well known in the U.S. and in Asia, an increasing number of Forex Brokers is accepting Liberty Reserve as a deposit option.

The best broker to make a deposit using Liberty Reserve is eToro. You can click here to make your deposit now!

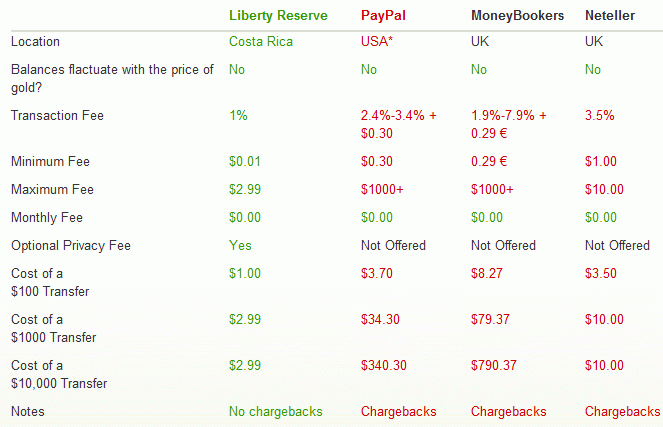

Comparison of Liberty Reserve Fees

On the Liberty Reserve website you can see that the fees are very low compared to other online payment services. While PayPal and Moneybookers are not ceiling their fees (which can result in fees of $300 or more), Liberty Reserve has a low maximum fee of just $ 2.99, while Neteller has a maximum fee of $ 10.

When you chose Moneybookers and PayPal, the fees can quickly rise to $ 100 or more when moving larger sums of money, for example by depositing money or withdrawing money with a Forex broker. When trading FX online, you might want to move larger sums of money. Not all Forex broker agree to carry the transaction costs by themselves.

Due to the low maximum fee of $ 2.99, Liberty Reserve can be a cheap alternative to Monyebookers, PayPal or the major credit cards.

However, using Liberty Reserve is not extremely easy. Many people from outside the U.S. and UK do not use LR because their website is not available in their native language. In contrast to PayPal, Moneybookers and Neteller, it is not possible to deposit money at Liberty Reserve by credit card. Also, withdrawals are not possible directly to the bank account. If you want to deposit or withdraw money from LR, you have to use an exchanger. With these independent money exchangers, you can deposit or withdraw money at Liberty Reserve. There are plenty of Liberty Reserve Exchangers available. Some of the better known LR exchangers are Goldexchange, Goldexpay, Exchangezone or Interexchange. These Liberty Reserve money exchange providers support payments by credit card or by PayPal.

Although the fees for transferring money between Liberty Reserve and its partners are low, a deposit or withdrawal of money from Liberty Reserve might not be as cheap as it seems. Keep in mind that the LR exchanger also wants to earn some money. If you already own a PayPal, Neteller or Moneybookers account, think about it whether it is really worth using LR or not. But if you are often transferring huge sums of money between two FX brokers, Liberty Reserve might be by far the cheapest option for you.

Forex Brokers accepting Liberty Reserve

Despite the rather complicated two-tier system with Liberty Reserve and the LR exchangers, the Liberty Reserve payment option is becoming more and more popular among online Forex brokers. Some reputable Forex brokers that we have reviewed offer Liberty Reserve as payment option: