The question of how many traders achieve a profit with Forex trading is often discussed between FX traders or in Forex discussion forums. We have made an analysis and come to the conclusion that only 10-20% of all FX traders achieve to make a profit.

It’s important to select a broker where only a small percentage of traders are losing money. This gives you the best chances to trade profitably these days. And brokers now have to be fully transparent when it comes to this percentage. Our recommendation for starting out is eToro where only 62% of traders are losing money. Click here to get started!

Analysis: Profit in Forex Trading

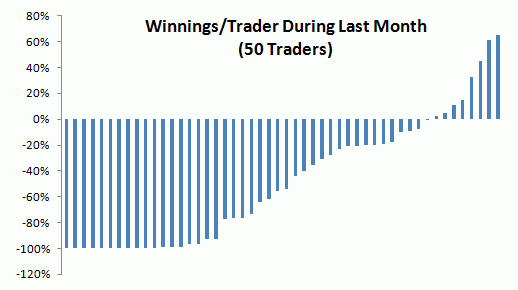

For our analysis we have randomly selected 50 FX traders from eToro whose data we have gathered from the eToro Open Book. The “Open Book” is just what is says, an open trading book. You can see there in real-time which trader has just bought or sold a currency pair and how much profit he achieved (losses are not shown in the eToro open book). In addition, you can see for every trader his trading statistics. So you can see in what percentage of trades he has made a profit and how his personal income statement looks for the last 30 days. The result is sobering: Only 8 of the 50 traders were able to achieve a profit:

About a third of the traders achieved a total loss or close to a total loss (90% or more lost).

The main statistical values from our analysis are:

- 8 of 50 traders (16%) achieved a profit

- The average loss was -48.5%, the median was -54.7%

- On average, 56.5% of the trades were completed with a profit

The last point is surprising – although five out of six Forex traders made a loss, more than half of the trades were closed with a profit.

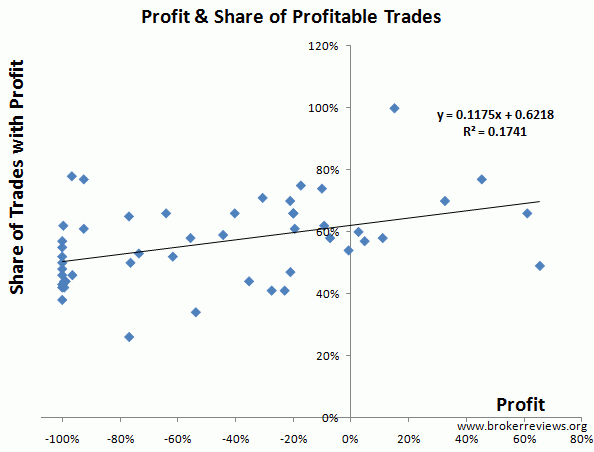

If we compare the profit per trader and the percentage of trades with a profit, we get the following picture:

A clear trend can not be derived. Presumably, the percentage of successful trades is not a reliable criterion to assess whether a trader made a profit overall.

Conclusions Analysis Forex Trader Winnings

Our analysis confirms what every trader should already know: Forex trading is very risky, and most traders lose money online. It is therefore extremely important to maintain a good Forex risk management. This means that only a small proportion of the money you have available should be risked in one specific trade. The risk of a total loss can be reduced considerably using this strategy. And that the vast majority of traders lose money is clear. Many small traders compete against the few pros. These professionals can make a profit – at the expense of many small traders. And don’t forget that FX brokers earn money with each trade by earning the spread. It is therefore not surprising that not 50%, but only about 10 to 20 percent of all FX traders make a profit.

Second, even those 10 traders who suffered a 100% loss, on average completed 48% of trades with a profit. This shows that they were trading quite successfully for a while, and then lost all of their money with a few completely failed trades. Thus, while their profit was often only a few percent, their losses were up to 100%: achieving small profits and making huge losses is a very bad trading strategy. It is therefore extremely important to know when to close a position before entering into that position, and then to stick to that decision. This means in practice that you should immediately put a stop loss order on your trades. This will help to reduce the losses to a tolerable level.

As a third consequence, the analysis shows that many traders seem to lack the necessary experience. We recommend to every FX trader to first gain experience without risking real money by trading with a free demo account. A FX broker with an unlimited trial account is eToro:

Click here to open a free demo account with eToro!