One of the most important things for a Forex trader is the observance of basic bankroll and risk management rules. The goal of Forex risk management is to reduce the likelihood of going bankrupt (of losing most of the money in your FX trading account) to a minimum.

It’s quite possible that you as an active Forex trader have not yet read an article on bankroll management. But you will know from experience that the variations of the results of your trades may be large. So the variance – the distribution of the results of your trades over time – can be very high. Maybe it has already happened that you that you closed five, ten or even more trades in a row with a loss. To limit losses, you can use stop loss orders. eToro for example is a Forex broker which easily allows you to place stop loss orders.

To prevent a total loss of the money you have deposited to your FX broker, you should therefore for each trade use only a small proportion of the money you have available for Forex trading. Of course, the smaller the amount you use per trade, the smaller the possible profit is. So if you trade with a conservative bankroll management, you will need more time to double your Forex bankroll. However, you reduce the likelihood of going bankrupt.

To understand the risk management in the area of Forex trading, it is important to distinguish the concepts of Forex risk management and Forex bankroll management:

Definition Forex risk management: all measures to reduce the risk of going broke as a Forex trader. These measures include, in addition to bankroll management, improving your mindset and using, sticking to stop-loss orders and other measures.

Definition of Forex bankroll management: specific Forex risk management measure, which limits the maximum stake per trade to a percentage of the capital stock a Forex trader has available. Example: If you stick to a 5% bankroll management, you may use up to 5% of your entire Forex trading assets per trade. So if you have deposited $ 8,000 at your Forex broker, you may only execute trades where you risk $400 or less.

When choosing how much to deposit at your Forex broker, FX bonus offerings play an important role. With the FX Broker InstaForex for example, you can get a $5,000 bonus. This is of course very lucrative and affects your bankroll decision. Click here to visit the InstaForex website.

Bankroll Management Limits Risk and Losses

The more money you lose in individual trades, the more difficult it becomes to reach the old bank balance again. Let’s say that you have speculated on the wrong currency and 50% of your bankroll is gone: you have lost $ 1,000 and your account balance is down to $ 1,000. To achieve the bankroll of $ 2,000 again, you must double your $ 1,000, so you have to make a profit of 100%. According to the same calculation, you must achieve 400% performance to recover from a one-time loss of 80% of your account balance – an almost impossible task. But you will face exactly such difficult tasks if you use too much of your account balance per trade. Check out the chart here:

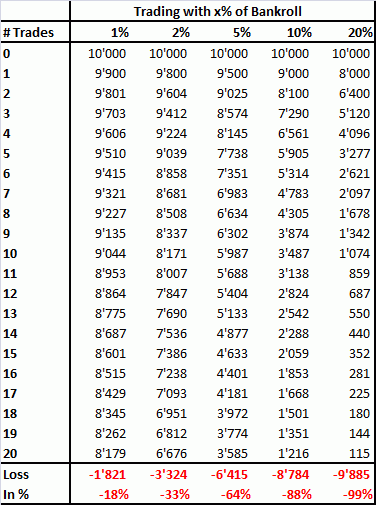

If you trade only with one percent of your Forex money and lose 20 trades in a row, then your balance decreases from the original $ 10,000 to $ 8’179, a loss of $1’821. Consequently, you have lost 18% of your online FX trading assets. However, if you use 20% of your assets per trade, then you can lose up to $ 2,000 with one trade. With only five such trades in row with a 20% bankroll management, your account balance will decrease to a meager $ 3’277, a loss of over two thirds of your entire capital!

Forex Bankroll Management and Variance

Variance is mathematically the sum of the squares of the deviations from the mean values divided by the number of measurement points. The standard deviation is the square root of the variance. Even if you have not studied math, you’ll understand variance in the way that the average trader understands it: “too” strong fluctuations in the results in a negative manner.

We have simulated the results of Forex trades in order to give you a better understanding of the possible variations in the results. And even the most successful traders have a high variance of their results! The results of these simulations should show you how important it is to stick to the elementary rules of bankroll management in order to minimize the risk of making a total loss.

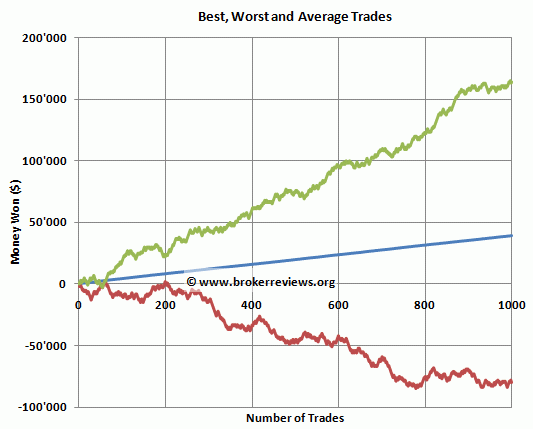

We have simulated the following situation: a FX trader executes 1,000 trades. With each trade, he risked $ 1,000 each. In 52% of the times he doubled his invested capital to $ 2,000, and in 48% of the times he loses his capital. Our trader is very successful: He scores an average of 4% return on investment (ROI) on his trades. So per $ 1,000 trade, he makes a profit of $ 40 on average. If he now executers 1,000 such trades, he should therefore make 1,000 x $ 40 = $ 40,000 profit. This is his expected value. In reality, the possible outcomes will be much different from this expected value, depending on whether our trader was lucky or unlucky. What would be the results if 10,000 different traders would make 1,000 trades at $ 1,000 per person with an expected 4% ROI?

The graph above shows the results of these 10,000 traders. The average profit after 1,000 trades is $ 40,000 (blue line). The luckiest of these 10,000 traders would have made a profit of $ 160,000, four times more than the average, although he should have the same ROI. And the biggest loser would have lost $ 80,000 (red line) even though he trades with a positive ROI. So the luckiest trader thus has won an additional 3 times of the expected profit of $ 40,000 (+$ 120’000) while the most unfortunate trader has lost 3 times the expected profit of $ 40,000 (-$ 120,000).

So even the very large number of one thousand trades cannot iron out “variance”. This shows that even successful traders can experience long runs of bad luck with huge losses.

Variance in Forex Trading

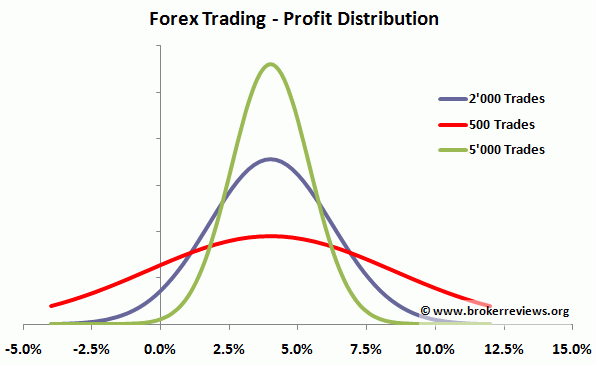

We have carried out further simulations with the above example. The following graph shows the probability distribution of the ROI over 500 Trades (red curve), 2,000 trades (blue curve) and 5,000 trades (green curve). We have carried out 10,000 simulations in each case:

If 10,000 times 5,000 trades (green curve) are executed with a ROI of 4%, then we have a narrow probability distribution. The average is 4%, and most results in the bell curve are close to the mean. Only a few times someone executing 5,000 trades will have a ROI of less than 0% or have a ROI of more than 8%. Quite different are the results after only 500 trades (red curve): here probability distribution is flat. Although most of the simulations showed a ROI of 4%, many results were negative.

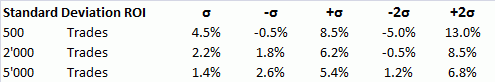

How strong the dispersion of the simulated results is can be measured with the standard deviation (symbol s). The results are shown in this table:

With 5,000 trades, the standard deviation is only 1.4%. This means that about 68% of the results are within a band of + / – 1.4% around the mean. Around 6,800 of the 10,000 simulations with 5,000 trades resulted therefore in a return between 2.6% to 5.4%. Two standard deviations include 95% of all results. A trader in our simulation will therefore achieve with a 95% probability a return between 1.2% and 6.8%. With only 500 trades, the standard deviation is massively greater, 4.5% instead of 1.4%. Thus 68% of the simulations resulted in a ROI between -0.5% and +8.5%. In other words, 16% of all traders will have achieved a ROI of less than -0.5% after 500 trades, even though these are actually profitable trader with an average ROI of 4%.

Summary of Forex Risk Management, Bankroll Management and Variance

The above calculations should have shown you how huge the variance even for a successful FX trader is. If you are a trader who either doubles or loses his invested capital, we recommend that you use only 1% to 5% of your capital for a single trade. If you invest more, then you can indeed earn more money faster, but you can also quickly deplete your account balance. Individual trades with 10% or more of your assets become a game of chance: You are better off at playing at the roulette table and to enjoy the casino atmosphere, because at least you will have some fun with your money before you lose it

Tip: Increase your income by signing up for a new Forex broker. This will give you a bonus of $ 1,000 and more!